| Partner's Profile |

|

|

Lamberto D. Torres

Partner, CPA, CFP

|

|

| |

| Areas of Special Expertise |

|

| • |

Income tax and financial planning for corporate executives, entrepreneurs, and high net worth/high income individuals |

|

| • |

Income, retirement, tax and financial planning |

|

| • |

Estate planning |

|

| • |

Forecast balance sheets and cash flows |

|

| • |

Stock option analysis |

|

| • |

Charitable remainder trusts |

|

| • |

Tax-deferred exchanges |

|

| • |

Subchapter S corporations |

|

| • |

Corporate liquidations and tax-free reorganizations |

|

| • |

Corporate taxation including consolidated returns for parent and subsidiary corporations |

|

| • |

Tax consequences of the sale or acquisition of a business |

|

| • |

Representation of clients before the Internal Revenue Service, Franchise Tax Board, and county property tax assessors |

|

| • |

Preparation of individual, corporate, partnership,

estate, gift, and trust income tax returns

|

|

| Prior Professional Experience |

|

| • |

Successful filing and collection of multi-million dollar refund claims from the Internal Revenue Service |

|

| • |

Successful filing of property tax refund claims |

|

| • |

Speaker at a number of tax planning seminars |

|

| • |

Arthur Young & Company, St. Louis, MO and San Jose, CA |

|

| • |

Ernst & Whinney, Los Angeles, CA (Ernst & Young 1975-1983) |

|

| • |

Joined the firm in 1983 |

|

|

| Education |

|

| • |

Certificate in Personal Financial Planning, University of California |

|

| • |

University of the East, Manila, Philippines, BA, 1970 |

|

| • |

Certified Public Accountant in CA, IL and the Philippines |

|

| • |

Certified Financial Planner, 2005 |

|

|

| Personal Information |

|

| • |

Member California Society of CPAs |

|

|

| |

| |

| |

|

|

| We offer a full range of tax and accounting

services tailored to meet your needs. |

|

| Whether you are : |

|

|

an individual |

|

a new business |

|

an established business |

|

|

|

|

|

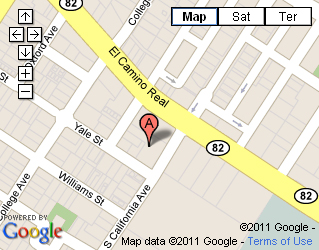

View Larger Map |

|

|

|

|